RPGT is a form of Capital Gains Tax that property owners and companies have to pay when they dispose of their property in Malaysia.

Purpose and significant changes on the RGPT Act

RPGT was first introduced in 1976 under Real Property Gains Tax Act 1976 with the objective for the government to prevent a potential bubble and curb any property speculation. Although it was introduced in 1976, it took 20 years to implement this act. It has undergone several amendments and was even suspended between 2007 and 2009 years. RPGT was introduced again in 2010.

The more notable and significant changes were the amendments introduced in the budget 2019, where there is a tax increase. There is an increase of percentage gain tax of 10% from 5% percent for companies disposing of properties in the 6th year. There is an increase of percentage gain tax 5% from 0% (death and taxes are intertwined). Besides, there is an increase to 10% of percentage gain from 5% for non-citizens and non-permanent residents.

In the budget 2020, some interesting changes were introduced. The RPGT is now assessed against a based year from 1st January 2000 to 1st January 2013. For example, if you bought a factory in 2009 at RM20 Mil and its value in 2013 was at RM40 Mil. The property's value is estimated against the property's valuation in 2013 and not the sale date. In this case, the factory is at the value of RM40 Mil.

What is the RPGT Rates Classification?

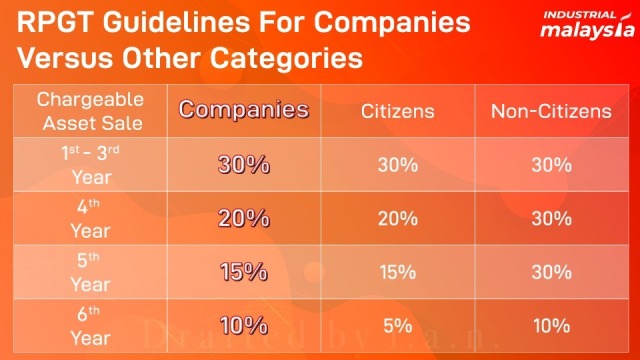

RPGT is classified into 3 categories: individuals (Citizens and Permanent Residents), individuals (Non-citizens or or non-permanent residents or foreigners), and companies. In this article, we will discuss more companies.

Do remember that the disposal of shares by companies are not subject to RPGT except Real Property Companies (RPCs) whose core business is primarily in real property. An RPC company means that it has real property or RPC shares that are more than or equal to 75% of its company's total tangible assets. However, if the company sells its shares or real property to a threshold where its RPC share falls below 75%, and it ceases to be an RPC, then the shares disposed of will be liable for the RPGT provision.

Besides, if a company reclassifies its real property from fixed asset to current asset, then it is also deemed as a disposal of a chargeable asset and is subject to RPGT. The disposal price of such purchases will be at their market value at the date of reclassification.

Do also note that a property development company will be regarded as an RPC as the real property includes the development land in Malaysia. Thus, it is subject to income tax and not RPGT.

How to calculate RPGT for Commercial and Industrial Property in the year 2022

The real property gain tax calculated when the disposal price (sale price) exceeds the acquisition (purchase) price, and there is a chargeable gain;

Disposal Price = Consideration received – Permitted Expenses – Incidental Costs.

The "disposal price "is arrived at by deducting permitted expenses and incidental costs from the consideration amount.

For example, AB Company Sdn Bhd bought a warehouse at RM 30 Mil in 2017 and sold it at RM60 Mil in 2022.

| Steps & Details | Calculation & Explanation |

| Step 1: Identify the disposal price | Disposal Price = Consideration received – Permitted Expenses – Incidental Costs In 2022, Consideration received : RM 60 Mil Permitted Expenses: RM 2 Mil Incidental Cost : RM 1 Mil Disposal price = RM 60 Mil - RM 2 Mil - RM 1 Mil = RM 57 Mil |

| Step 2 : identify the acquisition price | Acquisition price in 2017 = RM 30 Mil |

| Step 3 : calculate the chargeable gain | Chargeable gain = disposal price -acquisition price RM57 Mil - RM 30 Mil = RM27 Mil |

| Step 4: calculate the number of years and identify the RPGT percentage | From 2017 to 2022, it is 5 years. So, it is 15%. 15% of RM27 Mil is RM 4.05 Mil |

What is the deduction of the allowable expense?

Some of the expenses include property renovation and upgrading or preserving the chargeable asset's value after its acquisition. All these renovation works must have the proper council approvals, receipts, and documentation.

Incidentals Costs

Professional fees from the real estate agents such as engaging IndustrialMalaysia, property valuers, stamp duty, and legal fees are costs to be deducted as well. In the case of disposal, the cost of advertising to find a buyer or find a seller.

RPGT exemptions for companies

Under the RPGT Acts, some exceptions are provided to companies, which are found in paragraph 17, schedule 2 of the RPGT Act.

1) Transfers between companies for reorganization, reconstruction or amalgamation where the transferee company is being restructured to comply with the Government policy on capital participation in the industry. Besides, the transfers within the same group to bring about greater efficiency and for a consideration consisting substantially of shares in the transferee company.

2)The sales of properties to Real Estate Investment Trusts (REITs) .

3) The disposal of chargeable assets to the SUKUK Bank Negara Malaysia-Ijarah issued or published by BNM Sukuk Berhad.

4) The disposal of chargeable assets to the issuance of private debt securities under Islamic principles.

5) The land co-owned by two or more persons is partitioned to vest in each of them a portion of the land under separate titles, the partition of land is not regarded as disposable, and tax will not be imposed.

6) The assets distributed by a liquidator under a reorganization scheme, reconstruction, or amalgamation where the transferee company is being restructured to comply with the Government's policy.

7) The sale of assets in connection with the repurchase of the chargeable assets for a securitization transaction.

8) The disposal of asset is made in connection with the securitization of asset and special vehicle purpose approved by the Securities Commission from 1 Jan 2021

9) The gain accruing on the conveyance of chargeable asset upon conversion of convention partnership or private companies to a limited liability partnership RPGT

10) If there is no gain and no loss situation, this transaction is exempted from RPGT.

11) Disposal of chargeable assets including shares in real property company from 1 Jan 2013 to 31 Dec 2017 to a trustee-manager on behalf of a business trust established under the Capital Market and Services Act 2007

12) The disposal of chargeable assets after 24 Apr 2012 by the ASEAN Infrastructure Fund Limited.

13) The disposal of chargeable assets in relation to Sukuk Kijang with effect from 25 Jul 2013

It is important to note that the conditional contract is the disposal and acquisition date of the chargeable assets concerned depending on the date of the condition or the last conditions are fulfilled.

How to file RPGT in Malaysia

If you want to file an RPGT, you can obtain the necessary forms by downloading them from the IRB site or going to the nearest LHDN branch. There are 4 key steps to ensure the filling process is smooth.

First and foremost, search and fill the Disposal of Real Property (CKHT 1A) form, Sales and Purchase Agreement (SPA) form and other supporting documents

Then, complete the Notification under Section 27 in the RPGT 1976 (CKHT 3) form so you can apply for RPGT exemptions.

The next step is to ask your property purchaser to fill the Acquisition of Real Property (CKHT 4) form that comes with a copy of the SPA or Sale and Purchase Agreement.

Lastly, submit all forms and supporting documents to the nearest LHDN branch. Do note that seller and buyer have to file RPGT returns within 60 days from the transaction date. For more detail, you can also refer to the RPGT section under the IRB site.

Consequences of late RPGT

If you fail to make any payment after 60 days, the seller may need to pay the penalty. The penalty is 10% of the amount payable as RPGT.

How can you benefit from IndustrialMalaysia?

Our expert team can guide your company through all processes in investing in industrial properties, from understanding your company goal for the purchase, understanding investment site attributes and closing the deal. We can also help your company in determining the right time to buy, the right location to look at, and everything needed to close the deal. We are constantly watching the real estate rental market, conditions, and trends. Besides, we can help you engage tax consultants in the RPGT and stamp duty field and work with you to engage with the local and state authority for your buildings to have a smooth and efficient property purchase and disposal. Reach out to us at hello@industrialmalaysia.com.my if you are keen to know more about the warehouses and factories for sale or for rent.